I’ve been thinking about a few subjects not taught when I was in grade school, that would have been nice to know. The most obvious hole in the curriculum was money. There was a course called home economics, but that was for girls. I think it also covered cooking and cleaning, along with balancing a checkbook. I’ll never know.

I was probably in my 40’s when I finally figured out how much it costs to borrow money. Turns out it’s pretty simple math. But it would be bad for our economic system if we gave our kids a heads up. Loans make investors happy. Car Payments and Student loans produce reliable revenue streams. Debt makes the world go ‘round. As long as we make our payments.

When Lisa and I purchased our first home around 1983, we applied for a mortgage. Her Dad generously gave us the down payment, which we, of course, did not have. Fifteen percent of the purchase price. That was the minimum you needed, or you could not get a home loan. We were told without explanation that our interest rate was set at 15%. I’m glad I didn’t know how historically high that was. No questions. No shopping. Where do we sign, and when do we get the money?

All I cared about was whether my paycheck could cover the monthly payment. It did. And we wanted to own a house! Even then I surmised that we only owned 15% of it.

As dumb luck and Inflation would have it, we sold that home two years later for more than double our purchase price. We got a sensible 9% rate on our next mortgage. And we believed that house prices would never go down. For 20 years, they didn’t.

The baby boomer generation has been very lucky to live in mostly prosperous times. The US economy continued to expand, and as long as you could make your payments, buying things on time seemed to make good sense. If you waited, the price would go higher. Why wait? It never occurred to us that all of those news stories about the Federal Deficit or Trade Imbalances had anything to do with us common folk. I do remember that factories started closing in the 80’s. And the 90’s. And the 2000’s.

There’s lots of political rhetoric these days about other countries taking advantage of us. The other phrase you hear is that we shipped our jobs overseas.

You can take that at face value if you want, or you might look a little closer. Do you really envy the Guatemalan child laborer who made your sweatshirt for 37 cents? Is that Red Sox cap sewn by a father with a family of four from Bangladesh whose annual household income is in the 7-800 dollar range really taking advantage of you? Is he stealing a job you’d want?

Or could it be that to continuously raise our standard of living, all while borrowing and spending at deficit levels for most of our adult lives, we’ve propped ourselves up by offshoring our slave labor? That we took advantage of people who were poor.

Again, what would I know? I don’t have a degree.

Back to Education.

Shouldn’t we do better for the next generation of students? Wouldn’t that be great? Isn’t it about time we taught children the truth about numbers?

We could teach that borrowing is not “getting money”, it’s more like “renting money”. And what if we taught them that we are all citizens of the world, and to understand and respect the people who make all of the wonderful things we get to have. Would that be treason?

Best,

Bob

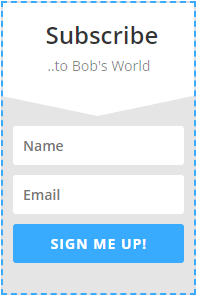

Your thoughts are always appreciated. Tomorrow, another subject poorly taught. Can you guess what it might be?